Sessions get recorded for you to access for quick revision later, just by a quick login to your account. Your academic progress report is shared during the Parents Teachers Meeting. Assignments, Regular Homeworks, Subjective & Objective Tests promote your regular practice of the topics. Revision notes and formula sheets are shared with you, for grasping the toughest concepts. WAVE platform encourages your Online engagement with the Master Teachers.

We provide you year-long structured coaching classes for CBSE and ICSE Board & JEE and NEET entrance exam preparation at affordable tuition fees, with an exclusive session for clearing doubts, ensuring that neither you nor the topics remain unattended.

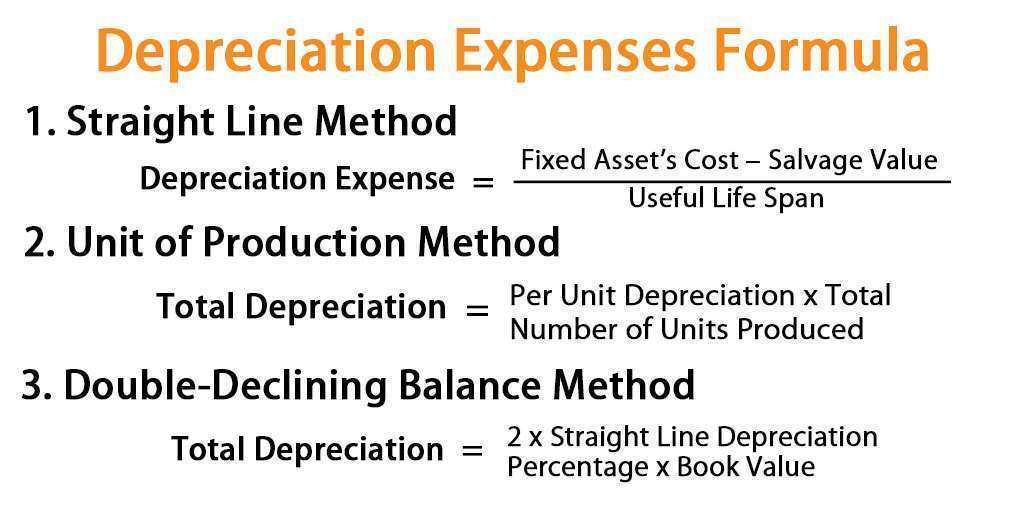

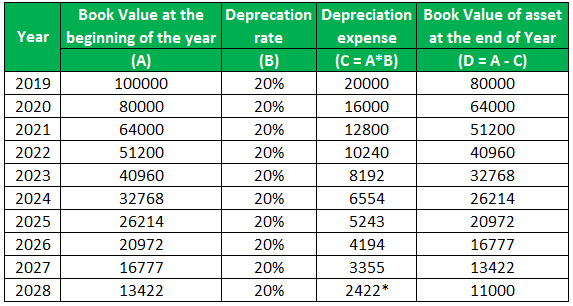

We have grown leaps and bounds to be the best Online Tuition Website in India with immensely talented Vedantu Master Teachers, from the most reputed institutions. Vedantu LIVE Online Master Classes is an incredibly personalized tutoring platform for you, while you are staying at your home. Vedantu provides an innovative learning experience for students. The notes are presented according to the CBSE standard of answering. The solutions are provided by teachers and professionals all across the country with years of experience under their belts. The solutions provided by Vedantu are thoroughly curated and revised by the team at Vedantu. Therefore, the book value of an asset is highly dependent on its ability to attract investors.īy opting for the online classes and solutions provided by Vedantu, you can enjoy several benefits of online learning. Similarly, the book value is a significant indicator of a business’s depreciation values and how much of them can be written off on the taxes of the business. Therefore, the significance of the book value of an asset lies with the asset’s allowance of depreciation over time. The book value is defined as the value of an item (asset) after the depreciation of the asset has been accounted for. While discussing assets for depreciation calculation in a stable marketplace, it is imperative to discuss the book value of the asset. Therefore, the Formula for the Depreciable Cost is: Original Cost- Salvage Value Defined as an asset’s cost which is susceptible to be depreciated with time it is, in effect, the same as the asset’s acquisition cost, without its salvage value. While discussing the assets of depreciation calculation, the facet of depreciable cost plays a big role. Straight-Line Depreciation Method= \ * Numbers of Years

Therefore, the formulas that are used in order to calculate the depreciation of an asset’s value in a market vary differently with the kind of method that is being used to calculate.Īs a result, the depreciation calculation formula is different for different methods. Therefore, these methods exist to carry out a number of depreciation formula accounting practices among firms and businesses in terms of their operations. Each of these methods serves a distinct purpose whether with regards to calculating depreciation expense or something else. With regards to calculating the decrease of the value of a company’s assets in a market, there are four primary methods that are used, namely: Straight Line Depreciation, Units of Production Depreciation, Sum of the Years’ Digits Depreciation and Declining Balance Depreciation. Therefore, through the ways of this article, these methods shall be discussed with respect to the cost of assets and more specifically the accumulated depreciation formula, among others. These costs, therefore, include several other components such as cost price, duties, handling expenses, among others. As a result, there are numerous depreciation calculation methods used to analyse these costs. However, the cost of assets for calculating depreciation includes several other key attributes as well, other than only money. Generally, when we talk about the cost of any particular asset, we tend to naturally think about the monetary aspects of the asset.

0 kommentar(er)

0 kommentar(er)